Medical debt in the United States is a major problem. While more than 90% of people have health insurance, many people are uninsured and even those with insurance may be subject to high deductibles and copays. An analysis from the Kaiser Family Foundation (KFF) uses data from the Survey of Income and Program Participation (SIPP) and finds that:

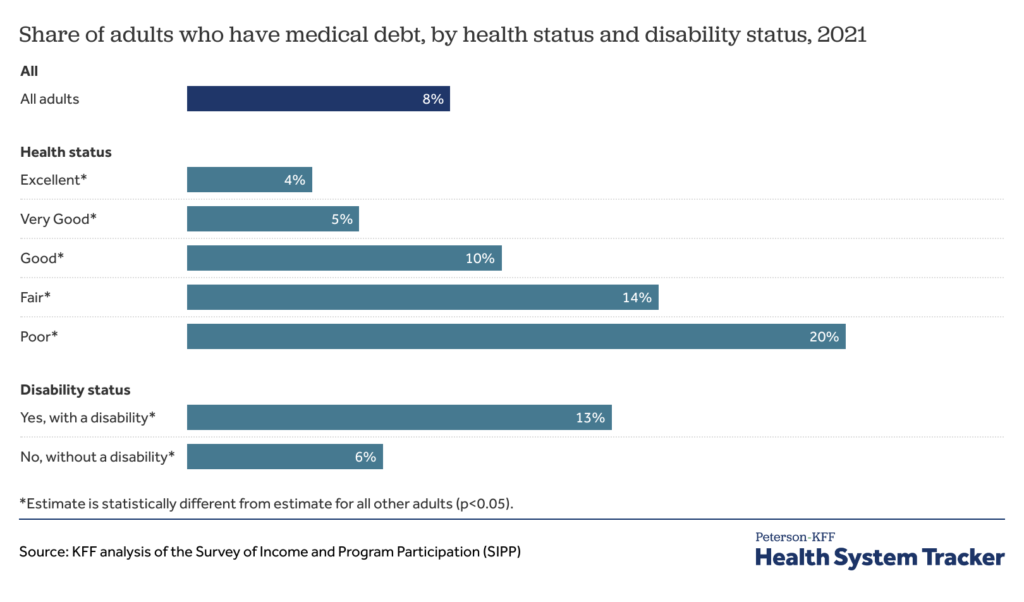

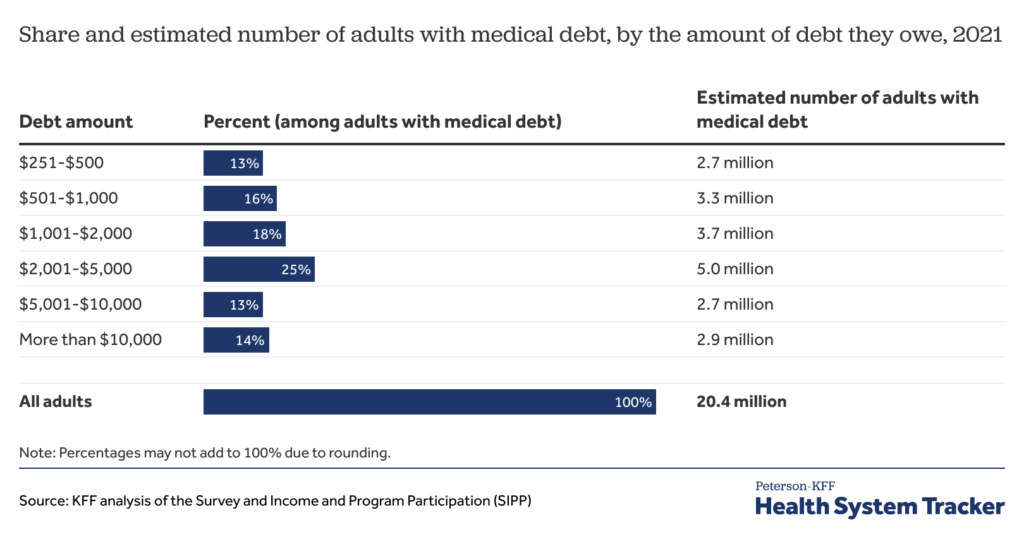

…20 million people (nearly 1 in 12 adults) have medical debt…people in the United States owe at least $220 billion in medical debt. About 14 million people (6% of adults) in the U.S. owe more than $1,000 in medical debt and about 3 million people (1% of adults) owe medical debt of more than $10,000. While medical debt occurs across all demographic groups, people with disabilities or in poorer health, low-income people, and people without insurance are more likely to have medical debt.

A key policy question, then, is “what would happen if we eliminated some or all of this debt?” According to an article by Kluender et al. (2024)The answer is not much.’

We partnered with RIP Medical Debt to conduct two randomized experiments that relieved medical debt with a face value of $169 million for 83,401 people between 2018 and 2020. We tracked the results using credit reports, collection account data, and a survey multimodal. There are three sets of results. First, we find no impact of debt relief on credit access, utilization, and financial distress on average. Second, we estimate that debt relief causes a moderate but statistically significant reduction in payment of existing medical bills. Third, we found no average effect of medical debt relief on mental health, with detrimental effects for some groups in the preregistered heterogeneity analysis.

He New York Times has additional coverage of this perhaps surprising result.