Today Nobel Prize winner Daniel Kahneman passed away. His work incorporates psychology into economics through Possible theory It has been a great advance. From the New York Times obituary:

Professor Kahneman delighted in pointing out and explaining what he called universal brain “distortions.” The most important of these, behaviorists maintain, is loss aversion: why, for example, does losing $100 hurt about twice as much as winning $100 gives pleasure?

Among its myriad implications, loss aversion theory suggests that it is foolish to review one’s stock portfolio frequently, since the prevalence of pain experienced in the stock market will likely lead to excessive and possibly counterproductive caution.

Loss aversion also explains why golfers have been found to putt better when looking for par on a given hole than when they birdie to gain a stroke. They try harder on a par putt because they want to avoid a bogey or missing a stroke.

For a good introduction to Kahneman’s contribution, you can read the book. Think, fast and slow. More technically, prospect theory helped resolve some of the key paradoxes of expected utility theory. From the Nobel Prize website:

Deviations from the von Neumann-Morgenstern-Savage theories of the expected utility of decisions under uncertainty were first pointed out by the 1988 economics laureate Maurice Allais (1953a), who established the so-called Allais paradox (see also Ellsberg, 1961, for a related study). paradox). For example, many people prefer a certain win of $3,000 to a lottery giving $4,000 with 80% probability and 0 otherwise. However, some of these same individuals also preferred winning $4,000 with a 20% probability to winning $3,000 with a 25% probability, although the odds of winning were reduced by the same factor, 0.25, in both alternatives ( from 80% to 20%, and from 100% to 25%). Such preferences violate the so-called substitution axiom of expected utility theory…

A surprising finding is that people tend to be much more sensitive to how an outcome differs from some non-constant reference level (such as the status quo) than to the outcome measured in absolute terms. This focus on changes rather than levels may be related to well-established psychophysical laws of cognition, according to which humans are more sensitive to changes than levels of external conditions, such as temperature or light.

Furthermore, people appear to be more averse to losses, relative to their reference level, than attracted to gains of the same size.

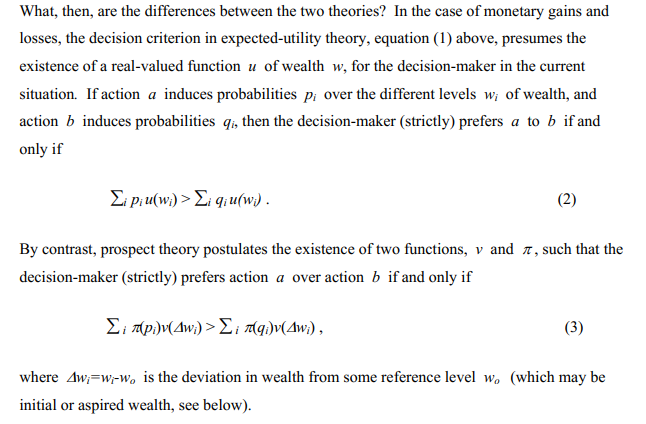

And some of the mathematics behind prospect theory:

Key differences between expected utility and prospect theory: (i) Expected utility is concerned with levels, while prospect theory evaluates changes compared to the status quo. [i.e., w vs. Δw](ii) prospect theory allows the utility function and risk preferences to generate gains relative to losses [i.e., u(w) vs. v(w)] ]and (iii) expected utility theory takes probabilities as given, while prospect theory uses decision weights that explain how individuals perceive these probabilities. [i.e., p vs. π(p)].

While prospect theory probably represents real-world human decision-making processes more accurately than expected utility theory, some criticisms of prospect theory would be that (i) with repeated games, individuals often return to a utility framework closer to what is expected and (ii) for For researchers, identifying a ‘status quo’ value for each individual is often a challenge in practice.

However, the Nobel Prize was richly deserved and the scientific contributions of Kahneman (and his collaborator Amos Tversky) will live on for posterity.