I just found a good general article titled The financial ecosystem of pharmaceutical R&D. The white paper was developed for the government of the Netherlands and provides an overview of the drug development process and how (and who) funds it. The white paper answers the following questions:

What do the different actors within the drug development ecosystem do?

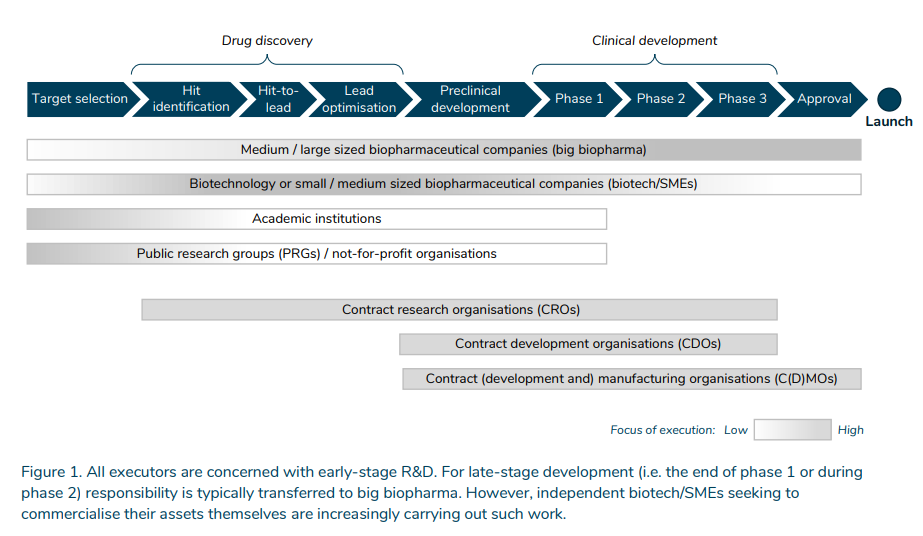

- Academic institutions and public research groups (PRGs)/non-profit organizations 1 are primarily concerned with targeting, that is, identifying disease targets, although they may also play a role in later phases.

- Biotechnology companies (biotech) or small and medium-sized biopharmaceutical companies (SMEs) are the most active in drug discovery, preclinical development and early-stage clinical development. Drug discovery involves finding and optimizing a drug candidate that interacts with the disease target. In the preclinical development phase, the safety and efficacy profiles of the drug candidate are tested in animal models and subsequently in human trials in the clinical development phases.

- Medium/large size biopharmaceutical companies (large biopharmaceuticals) are active along the entire value chain. They are the critical executors of late-stage clinical development. Responsibility is typically transferred to large biopharmaceuticals from the end of Phase 1 or during Phase 2. However, such work is increasingly being carried out by biotechs and SMEs seeking to commercialize their own assets.

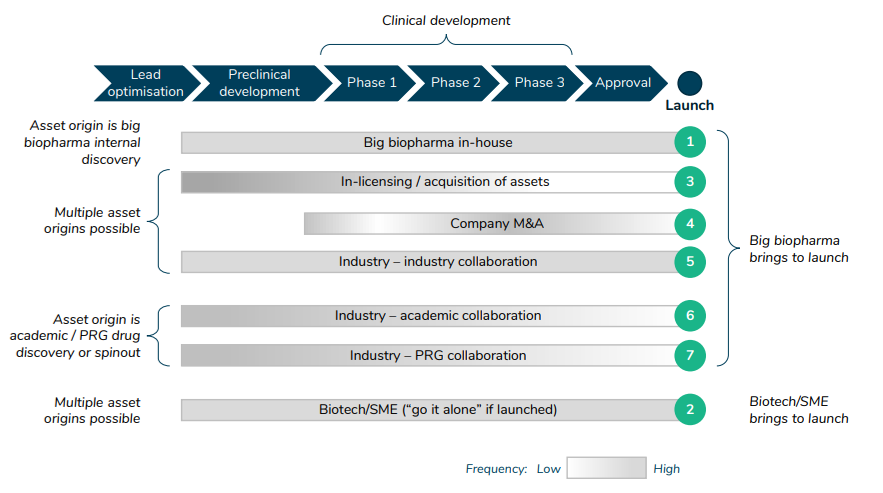

What are the typical archetypes of how different stakeholders interact in the drug development process?

The article also lists seven different archetypes for drug development.

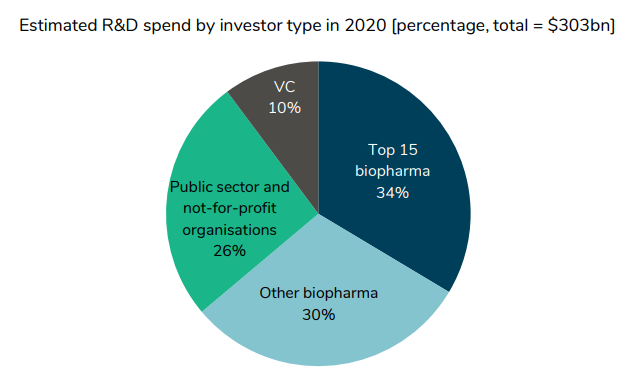

Who finances drug development?

About two-thirds come from private sector life sciences companies. However, we see that between 2011 and 2019, private sector financing has increased. Venture capital funding has grown 14.2% annually, biopharmaceuticals 4.1%, but the public sector and nonprofits only grew 1.1% and 0.8% respectively.

A case study of how nonprofit organizations and biopharmaceutical funding interact is shown in the recent development of numerous cystic fibrosis drugs.

Since in the late 1990s there were only a few therapies available to treat the symptoms of cystic fibrosis (CF), the Cystic Fibrosis Foundation (CFF) sought to support the development of disease-modifying therapies. CFF wanted to make strategic investments in pharmaceutical companies explicitly aimed at developing therapies for cystic fibrosis. In 2000, CFF partnered with Aurora Biosciences to identify disease-modifying molecules. Vertex Pharma acquired Aurora Biosciences in 2001, but did not invest heavily in this CF franchise due to its strong strategic focus on virology. When Kalydeco entered Phase 1 testing in 2006, CFF funded an additional $37 million. The successful results of this phase encouraged Vertex to invest in creating more R&D and marketing capabilities for the CF franchise. Additionally, the CFF funded an additional $75 million after Phase 2 trials began. After its approval in 2012, Kalydeco saw commercial success. CFF benefited by selling its royalty rights to Kalydeco in a $3.3 billion deal that they reinvested in CF research

How much does it cost to develop a drug?

It is expensive:

Whether launched successfully or not, a lead company’s direct R&D costs for a compound are estimated at $280 million to $380 million. However, if the R&D costs of failed drugs are included, the estimated out-of-pocket costs to the system for developing an approved drug rise sharply to between $1.2 and $1.7 billion (§2.3.2). Adding the capital cost, the total R&D cost for the system amounts to an estimated $2.4 to $3.2 billion for each approved drug.

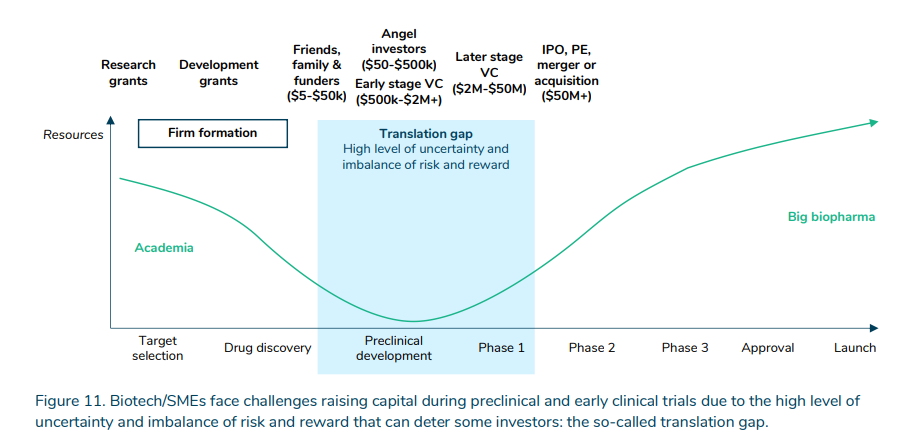

More than the expense, there is the uncertainty. Government, nonprofit, and venture capital help close the “translation gap” between early-stage basic science research, targeting and drug discovery, and preclinical and clinical trials.

How sensitive is R&D investment to drug revenues and/or market size?

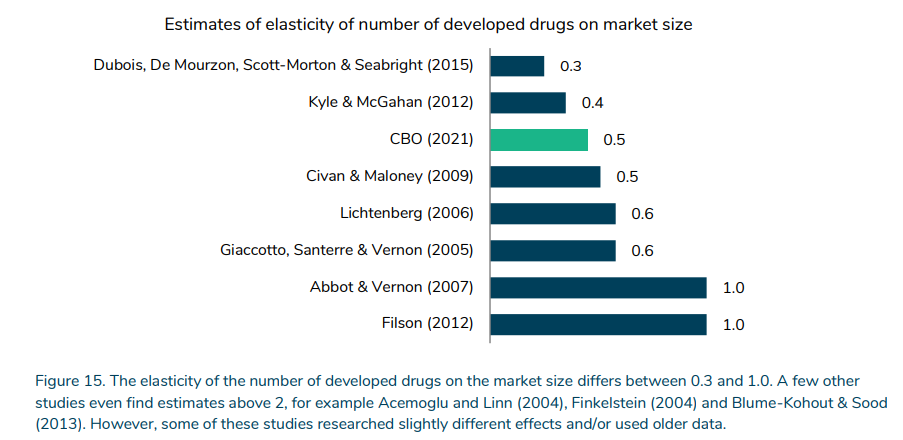

A key figure is the response of drug development to expected revenues. This elasticity ranges from 0.3 to >2.0, but the figure below focuses on more recent studies where the range is 0.3 to 1.0.

The full report can be read here.