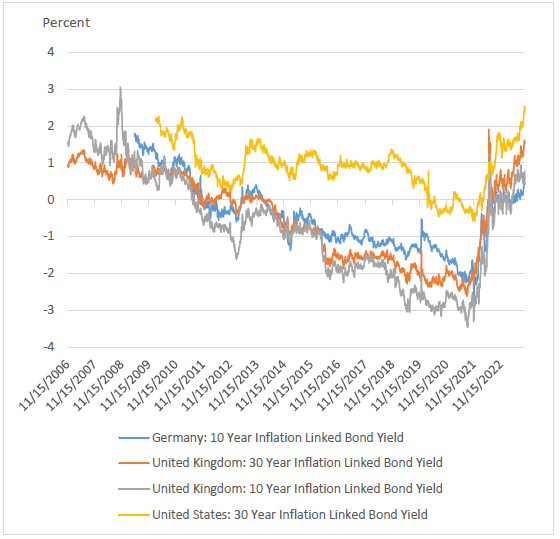

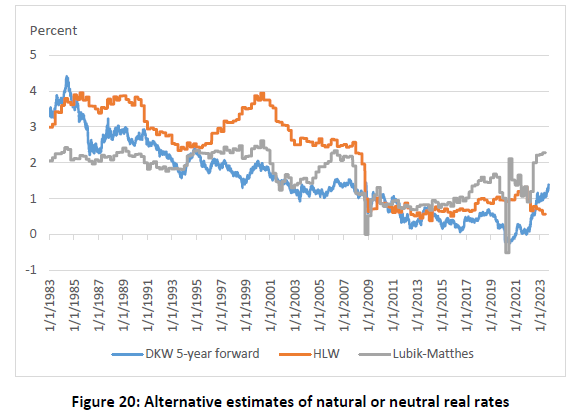

…well, at least real interest. While the years since the COVID-19 pandemic have seen nominal interest rates rise, over the long term real (i.e., inflation-adjusted) interest rates are falling. An NBER working paper prepared by Obstfeld (2023) provides compelling evidence for this trend. Current real interest rates are likely to be somewhere between 1% and 2%. Reasons for this trend include “demographic changes, lower productivity growth, corporate market power, and demand for safe assets relative to supply.” Below are some graphs showing this trend.

One reason this would be important for health economics is that many cost-effectiveness analyzes include a discount rate that discounts future health gains and costs relative to the health gains and costs that accrue in the future. present. Often, that discount rate is linked to the economy’s real interest rate. If the real interest rate is falling, should the discount rate used for cost-effectiveness models and value assessment in general also fall? One would think so

You can read the full article. here.