He Biden The administration is implementing a framework to enforce government authorities over drugs developed with taxpayer dollars, saying that if drug makers refuse to make their products “reasonably” available, then the government is prepared to license others. companies to produce those drugs at a reasonable price. lowest cost….

If the company refuses to grant a license for its product, the government has the authority to grant it itself. These are known as entry fees, as they allow the federal government to “come in” and issue a license for a product on its own.

For politicians, confiscating patents to reduce drug prices may seem like a good phrase. However, does it stand up to economic scrutiny?

My colleagues and I at FTI Consulting and I wrote a white paper titled “The role of intellectual property in the biopharmaceutical sector“…which examined the well-being of consumers, producers and society in scenarios in which governments would seize patent rights to 10%, 25% or 50% of patented pharmaceutical products. The analysis found that:

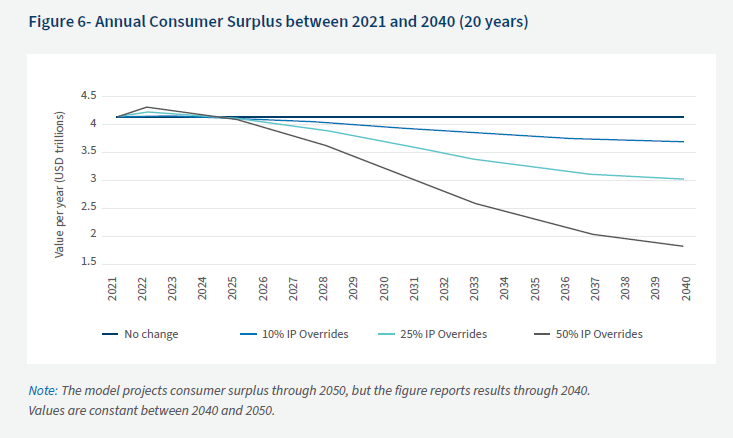

In the short term, consumers benefit from the elimination of intellectual property protections because weaker protection, for example, waiving patents, reduces prices and has only a limited impact on innovation in the short term. However, after only three years, consumers become worse off relative to the status quo and are significantly harmed in the medium and long term.

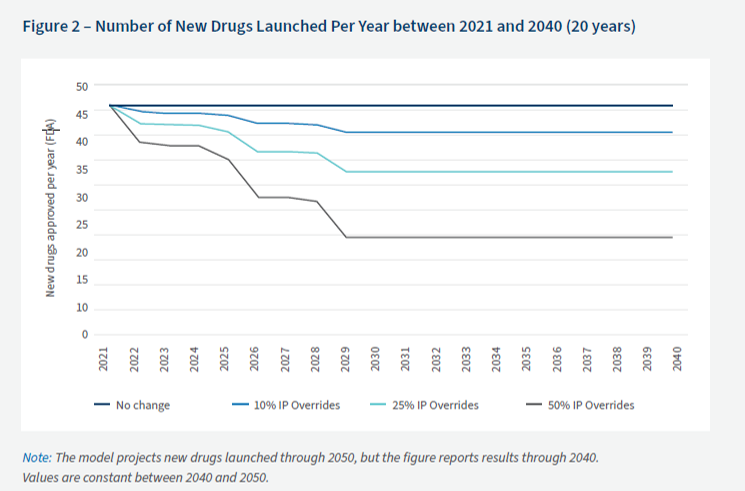

The reason for the reduction in consumer surplus is that the threat of patent seizures results in less R&D investment and less drug development. In fact we find that:

…by renouncing patents for 25% of medicines, annual investments in R&D would fall by 9%, 11% and 29% for the years 2023, 2025 and 2030, respectively. Removing intellectual property from 25% of medicines would result in a reduction in the number of new medicines launched per year from 46 in 2021 to 33 in 2050.

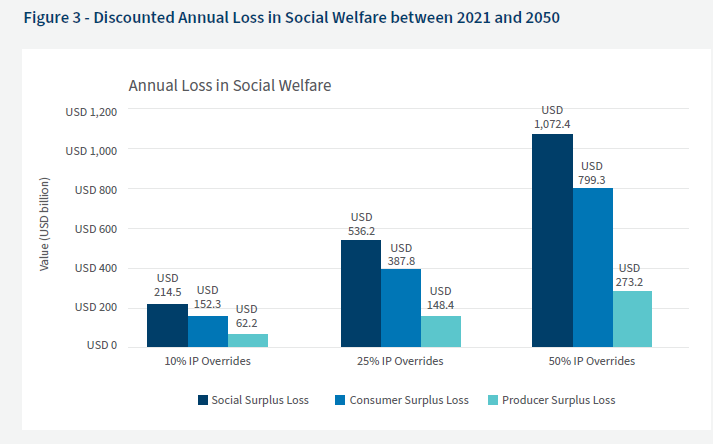

If Biden’s entry duties were applied broadly, the potential long-term impact on social well-being could be enormous.

…a 25% chance of repealing intellectual property protection for drugs reduces the social surplus by $16.1 trillion ($536.2 billion per year on average, or 0.6% of global GDP) between 2021 and 2050.

Of course, producers also suffer from patent confiscations. While many politicians focus on the impact to Big Pharma, failing to protect intellectual property rights also hurts small biotech companies, as well as universities with technology transfer offices (TTOs).

In short, President Biden’s focus on drug prices in the short term is likely to have much larger negative implications in the medium and long term for patients and society.