According to a recent article by Doshi et al. (2023)the answer is ‘Yeah‘! Why do people think otherwise?

Many people are concerned that there is no sustainable way for the private group insurance market, especially at small self-insured companies, to cover gene therapies. If a company (especially a smaller, self-insured one) gets one or two patients who need gene therapies, this could ruin their profitability for reasons that have nothing to do with the underlying expense.

However, gene therapy is the perfect case for why insurance is needed:

After all, the primary goal of insurance, in theory, is to convert a large, unexpected, unaffordable, but rare expense into a moderate insurance premium, spreading a large individual expense across many premium payers.”

Furthermore, in a competitive market, companies’ decision to cover profitable gene therapies can be a competitive advantage in attracting labor.

…employers competing for risk-averse workers will offer such financial risk protection if they want to match what other employers (large or small) offer.

However, the issue may still be relevant for small businesses that self-insure and do not have stop-loss provisions for patients with atypical costs. Companies self-insure for three main reasons (i) state taxes do not apply to self-insured plans, (ii) companies have more control over self-insured plans, and (iii) costs can be lower if the company has a healthy healthier than the average population. What are stop loss provisions?

Stop-loss insurance is a form of insurance in which a third-party insurer agrees to cover the self-insured employer’s claims that exceed some pre-established limits. Provides funding for unusually large claims or claim sums.”

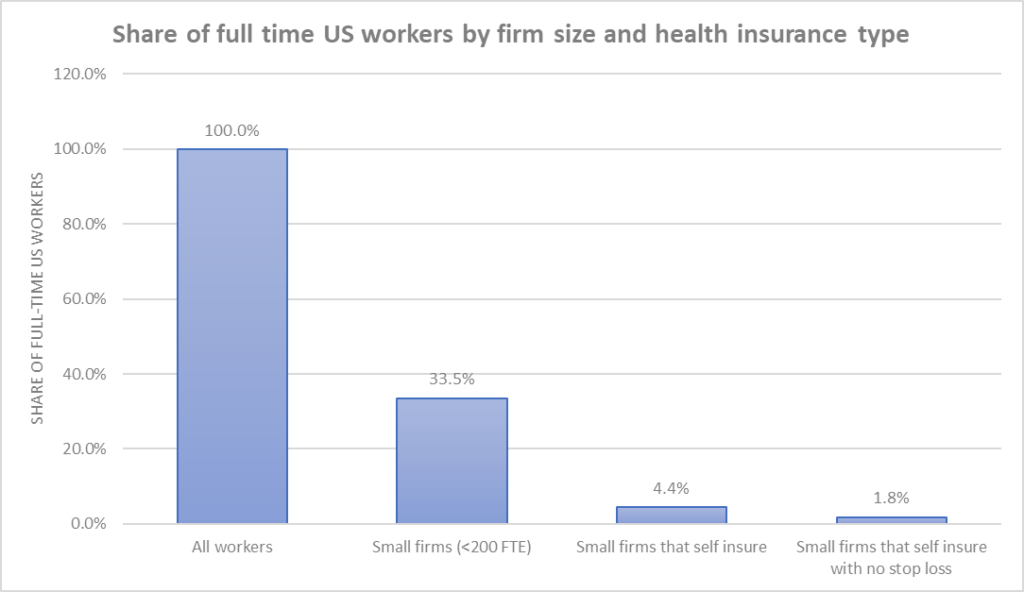

How many workers are included in this type of companies? Doshi et al. use data from the Medical Expenditure Panel Survey Insurance Component (MEPS-IC) and the Kaiser Family Foundation (KFF) Health Benefits Survey of Employer Health Benefit Offerings to find out. In general, only 1.8% of workers are employed in self-insured small businesses without any stop-loss provisions.

Furthermore, they find that MEPS data reveal that even among self-insured small businesses with <200 FTE, 59.2% (MEPS) or 72% (KFF) have a stop-loss provision.

It is true, however, that the cost of stop-loss hedging has been increasing over time. Between 2012 and 2022, stop-loss insurance coverage increased 138% compared to family premium increases of just 43% during that same period.